READING YOUR ELECTRIC BILL

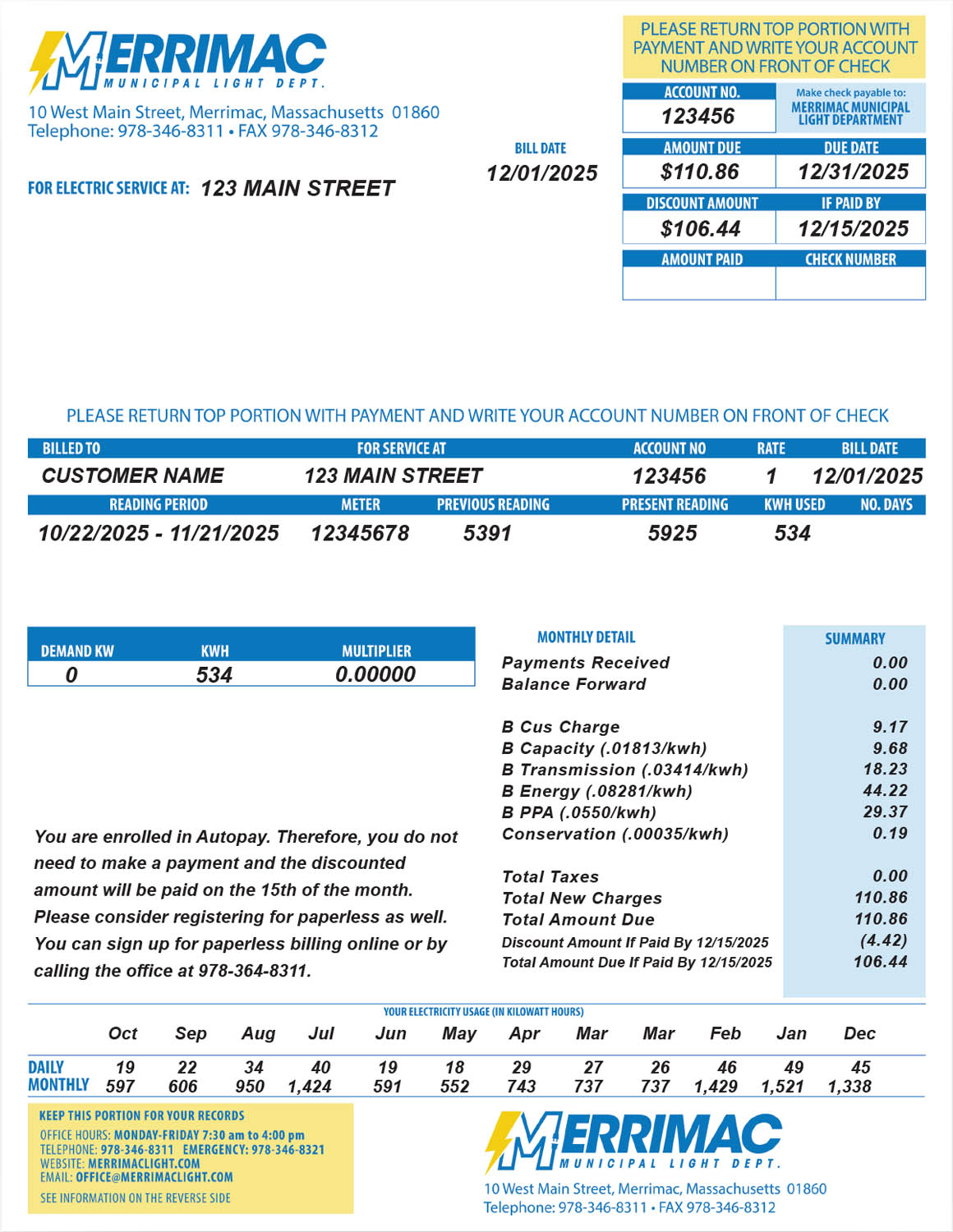

Check Number

Customer writes in the check number

Amount Paid

Customer writes in the amount they're paying

Return with Payment

The top portion of the bill gets returned with your payment

Service Address

The location where electric service is provided

Service Address

The location where electric service is provided

Billing Date

The date the bill was issued

Billing Date

The date the bill was issued

Rate

This corresponds to the type of rate and there are 6 of them in Merrimac. Click to learn more.

Account Number

The number used to identify this account.

Account Number

The number used to identify this account.

Prompt Payment Discount

The total amount due for this bill if payment is received before the current discount due date.

Prompt Payment Discount

The total amount due for this bill if payment is received before the current discount due date.

Discount Due Date

The date the payment must be received by MMLD to receive the prompt payment discount.

Discount Due Date

The date the payment must be received by MMLD to receive the prompt payment discount.

History

A 12 month history of this account, showing kilowatt-hours and demand

Multiplier

What the consumption is multiplied by to obtain an accurate read.

Demand

For the customers using a rate that requires a demand meter, this figure is the kilowatt reading from that meter.

Read Dates

Time period for which you are being billed for consumption.

Meter Number

The number used to identify the meter

Previous Read

Meter read from the previous billing period

Present Read

Meter read for the current billing period

Payment Received

Total payments received as of the current billing date

Capacity

Transmission

Energy

PPA

Conservation

Based on consumption – a charge to provide services and programs to promote energy efficiencies

Total Taxes

Massachusetts sales tax requires all energy companies to collect 6.25 percent sales tax on all sales of gas, steam, electricity and heating oil (energy) EXCEPT for exempt customers. Click for full details.

Total New Charges

The amount due for this bill

Balance Forward

Total of previous balance remaining net of payments and adjustments

Customer Charge

This is a fixed charge for every rate payer to help with the distribution costs of providing electricity. This charge also covers the costs incurred for the maintenance of the meters.

Kilowatt-Hours Used

The number of kilowatt-hours used during this billing period, obtained by subtracting the previous read from the current read.

Kilowatt-Hours Used

The number of kilowatt-hours used during this billing period, obtained by subtracting the previous read from the current read.

Days

The number of days covered by this bill

Sales Tax

Massachusetts sales tax requires all energy companies to collect 6.25 percent sales tax on all sales of gas, steam, electricity and heating oil (energy) EXCEPT those sales to:

- Residential Customers;

- Small businesses with five or less employees;

- Customers who use 75 percent or more of their energy in the actual Manufacture at an industrial plant of tangible personal property to be sold or in the heating of the industrial plant;

- Tax-exempt organizations that hold a valid Certificate of Exemption (ST-2) form from the Commissioner of Revenue.

The sales tax will be added to charges for energy used and will be shown on your bill. If you believe that your account is entitled to an exemption from sales tax, you must complete and return an exemption certificate to the department.

If you have any questions on whether you are entitled to an exemption for your account, please call the Merrimac Light Department at 978-346-8311 or the Massachusetts Department of Revenue at 1-800-392-6089.